Universal Preservation Hall – built in 1871 – will take advantage of the NYS Historic Tax Credits.

Over the years, I have shared success stories about several large-scale preservation projects that would have not been possible without the combined 40% State and Federal Commercial Tax Rehabilitation Credits – the Adelphi Hotel, Algonquin, and Woodlawn Row Houses to name a few. Soon, Universal Preservation Hall will be under construction and will also take advantage of the incentives. These projects have been possible because costs that can amount to millions of dollars have been offset.

Just as valuable as our commercial properties are Saratoga Springs’ distinctive historic residences, withmany homeowners qualifying for a 20% New York State Historic Homeowner Credit. Together, these programs have been responsible for the revitalization of countless vacant and unutilized historic properties across the state.

Kasia and her two children, Hannah and Kai, inside their newly purchased home of 184 Spring Street.

The Foundation recently helped Kasia and Adam Israel secure the NYS Historic Homeowner Tax Credits for their new home at 184 Spring Street. With a family that has a long tradition of preserving buildings in Saratoga Springs, it is no surprise that the Israels want to return the circa 1868 house that had been sub-divided into three units back to a single-family residence. The house requires extensive work. “You name it, we are doing it – fixing the roof, restoring the porch, repairing interior and exterior walls, windows and doors as well as installing new electrical, plumbing, and insulation! The tax credits are a huge help as we undertake this project,” shared Kasia. When asked about the application and review process, Kasia responded, “Wanting to do the right thing and preserve as much of the house as we could combined with the technical assistance that the Foundation provided, the process was relatively easy.” The Foundation assisted by providing guidance on researching the history of the house, reviewing the application, photographing the house and creating a photo map for a fee.

Exterior of 184 Spring Street, located within the East Side Historic District.

To be eligible for the historic homeowner tax credits, a building must be owner-occupied by a New YorkState taxpayer, located in a qualifying census tract, and be identified as a contributing building to a historic district or individually listed on the National Register of Historic Places. Eligibility is dependent on properties being in census tracts that are at or below the median family income level.

As of January 1, 2018 with the newly released census information, areas that had previously been eligible for Historic Homeowner Tax Credits were no longer going to be. The Saratoga Springs Preservation Foundation was concerned about this potential impact to historic property owners and this past legislative season it worked with Assemblymember Carrie Woerner, former Foundation Executive Director, to address these concerns. Led by Woerner, legislation was passed and signed by the Governor that will maintain eligibility for the expiring census tracts until April 1, 2020 and, more importantly, the legislation extended NYS Historic Tax Credits for 20 years, which were set to expire in 2019. “The extension of the Historic Tax Credits ensures that investment into the historic downtowns of upstate communities continues. These tax credits have proven to be one of the most effective tools we have to revitalize our communities. I was pleased to lead the effort to extend the tax credits and I look forward to continuing to work with the Preservation League of New York State and Office of Parks, Recreation, and Historic Preservation to further enhance the credits making upstate New York an even more attractive place to invest as well as to live and work,” commented Woerner.

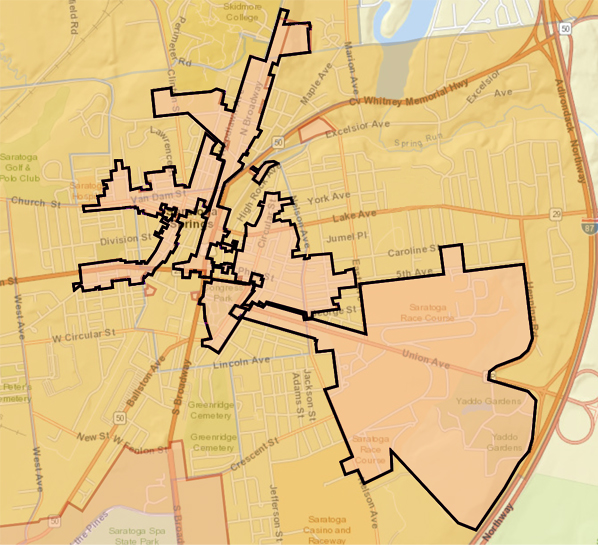

With the passing of this legislation and the newly eligible census tract, hundreds of structures in Saratoga Springs are now eligible – any owner-occupied house that is identified as a contributing building to a historic district or individually listed on the National Register of Historic Places. Eligible districts include: the Casino-Congress Park-Circular Street, East Side, Franklin Square, West Side, and Union Avenue Historic Districts. Several of the boundaries of these districts are larger than the boundaries established for the city’s local historic districts. Please refer to the map that shows eligible areas.

Areas outlined in black are those that are eligible for NYS tax credits.

Eligible projects for the homeowner credits include repairs or replacement in-kind of wood, masonry, interior and exterior finishes, floors and ceilings, plaster, windows, doors, chimneys, interior and exterior stairs and roofs. New heating, central air-conditioning, plumbing and fixtures, electrical wiring and fixtures, solar, geothermal and other mechanicals are also eligible. Projects such as landscaping, fencing, additions, and garage rehabilitation generally do not qualify.

Please visit parks.ny.gov/shpo/tax-credit-programs/ for more information and to determine if your property is eligible. For further assistance and information, please contact the Saratoga Springs Preservation Foundation at (518) 587-5030.

Founded in 1977, the Saratoga Springs Preservation Foundation is a private, not-for-profit organization that promotes preservation and enhancement of the architectural, cultural and landscaped heritage of Saratoga Springs.